$FSLR

07.08.25

Investment Thesis:

- SO: 107,250,000 * Price ~165 = $17,696, 250,000

- EV: 17, 696, 250, 000 + 373,000,000 - 1,793,000,000 = $16,276,250,000

- P/E = 14x LTM

1).

Large market share of US solar: FSLR is the only large, US-based, vertically-integrated manufacturer of utility-scale solar panels. This creates a dominant, near-monopoly position within the domestic US market. It means FSLR is the primary and most direct recipient of any US industrial policies and incentives (like the IRA) aimed at building a domestic solar supply chain (yes, despite the revisions from the current administration, they still stand to benefit, because effectively, they have now restricted competition).

The company uses proprietary thin-film (Cadmium Telluride) technology, not the industry-standard crystalline silicon (c-Si). It makes FSLR independent of the polysilicon supply chain, which is heavily dominated by China. This insulates the company from geopolitical tensions and supply disruptions.

The thin-film process uses less energy and water, giving its panels a superior environmental profile. This is a significant non-price differentiator for large corporate buyers with their own ESG (Environmental, Social, and Governance) mandates.

2).

The build-out of AI data centers is creating an unprecedented, power-intensive demand. Solar is the fastest-to-deploy new electricity generation source (8-18 months) compared to alternatives like natural gas or nuclear (5+ years).

This creates a new, massive, and urgent demand vertical for FSLR. For hyperscalers racing to build AI capacity, power is the main bottleneck. The speed of solar deployment makes it an essential, non-negotiable component of their build-out, not just an optional "green" choice. As the key US supplier, FSLR is positioned to capture this urgent demand.

U.S. industrial policy is focused on reshoring critical technology manufacturing to reduce dependence on foreign (primarily Chinese) value chains. FSLR is a direct instrument of this national security policy. It benefits from a protected domestic market (via tariffs on imports) and direct subsidies (via the IRA) designed to ensure its success as the domestic champion.

The bill also restores 100% immediate expensing, allowing businesses to write off investments, expansion, and modernization. It will empower Main Street to expand, hire, raise wages, and reinvest in their communities, while also providing significant tax relief for ordinary folks. All Republicans should unite to support this historic reconciliation bill. We need Tax Cuts Now.

This is a massive advantage for domestic players - I think it benefits for two reasons: on one hand you limit competition from cheaper solar producers and on the other hand you enhance larger players in domestic markets (vs smaller ones that may not have cost advantages).

3).

President Trump and the One Big Beautiful Bill Act did not repeal the IRA Section 45X manufacturing tax credits that benefit First Solar (FSLR); the credits for solar manufacturing are maintained and largely unchanged, though guardrails have been added, and timelines for phase-out remain as originally set in the IRA—beginning in 2030 and expiring in 2032. The wind component credit was terminated after 2027, but solar remains protected.

The company is projected to accumulate a cash balance exceeding $12 billion by 2028, largely fueled by these tax credits.

The new bill also introduced 100% upfront capital investment deductions for new US projects, which positively affects demand and profitability for First Solar’s customers and installers. Combined, these policies reduce political risk around the IRA credits and create fresh incentives for domestic manufacturing and installation.

There are new restrictions related to projects with foreign entities of concern (“FEOC”), and companies must meet stricter content and sourcing requirements for credits. However, for FSLR—which manufactures in America and is not subject to these restrictions—the financial thesis remains intact, with continued high-margin government-backed support and an expected $12 billion cash balance by 2028.

4).

Lastly, FSLR has a solid management team, where the CEO & CFO has been there since 2016 - which have proven execution and stability. This team has successfully navigated multiple cycles and administrations, increasing confidence in their ability to manage the current growth phase and allocate capital effectively.

Risk: The counter-thesis is that the narrative has shifted from "green energy" to "national security" and "industrial policy." The demand for power to fuel the AI boom and the bipartisan desire to onshore critical manufacturing (and compete with China) are powerful tailwinds that likely transcend partisan politics. I believe that a sign to hint at this is the preservation of the IRA credits in the recent bill supports this view that the industrial policy component is durable.

Introduction:

Headquartered in Temple, AZ, First Solar (FSLR) was originally founded in 1999, and IPO'd in November 17, 2006. It is one of the most important names in U.S. solar manufacturing — with ~30% market share in utility-scale solar (think large solar farms and commercial projects).

The company designs, manufactures, and sells photovoltaic (PV) solar modules built on thin-film semiconductor technology — a high-performance, lower-carbon alternative to conventional crystalline silicon solar modules. Its technology is particularly well-suited for utility-scale applications, where efficiency, reliability, and cost of energy output matter most.

The key difference between them and other producers of solar are that they use cadmium telluride (CdTe), a thin-film semiconductor technology. Unlike traditional crystalline silicon panels, FSLR’s modules perform better in high-temperature and humid environments — producing more energy per watt under real-world conditions. Just as important, the manufacturing process is less carbon-intensive and entirely independent of the Chinese polysilicon supply chain — a huge differentiator given today’s geopolitical backdrop. However, silicon-based panels remain far more cost-effective, which has historically been a major competitive risk for FSLR. Recent policy changes, though, have effectively shielded the company from that pressure by favoring domestically produced technology — a crucial advantage in a world where energy demand continues to climb, particularly from hyperscalers building data centers and large-scale infrastructure.

Geographically, about 97% of revenue comes from the U.S., positioning FSLR as a clear beneficiary of domestic energy and manufacturing policy tailwinds.

FSLR's major segment is the; Module Business (99%+ of revenue) — This is the core of the company. It encompasses the design, manufacturing, and sale of thin-film solar modules to developers, independent power producers (IPPs), and large-scale utility customers.

So what? what makes FSLR more unique?

As mentioned, First Solar stands out in the global solar industry due to its proprietary thin-film technology, which uses Cadmium Telluride (CdTe) instead of the standard polysilicon used by nearly every other manufacturer. This distinction makes First Solar the only fully integrated solar company operating independently from China’s polysilicon-dominated supply chain—a critical strategic advantage in an era of trade tension and U.S. industrial reshoring. CdTe has several technical advantages over traditional silicon: it requires only 2–3% of the semiconductor material used in silicon panels, performs better in hot and humid conditions, is more resistant to partial shading and cell cracking, and degrades more slowly over time. These features make First Solar’s panels more durable and efficient in real-world operating environments. Note that the most efficient solar panels have about 25% efficiency at max (the total amount of energy that goes to usable energy is 25%). Hence, when you extrapolate this on a GW scale farm, a small 2-3% is massive.

While silicon-based panels benefit from large-scale cost efficiencies—driving production costs down to around 15¢ per watt—this scale is only achievable in China, where the entire supply chain is concentrated. First Solar’s vertically integrated model, which manufactures everything in-house, currently produces panels at roughly 18–19¢ per watt, or around 24¢ per watt all-in. However, thanks to U.S. tariffs on Chinese imports and the generous manufacturing tax credits under the Inflation Reduction Act, this cost gap is more than offset. The result is a domestically sourced, more sustainable, and ethically produced solar solution that is increasingly competitive on both cost and reliability.

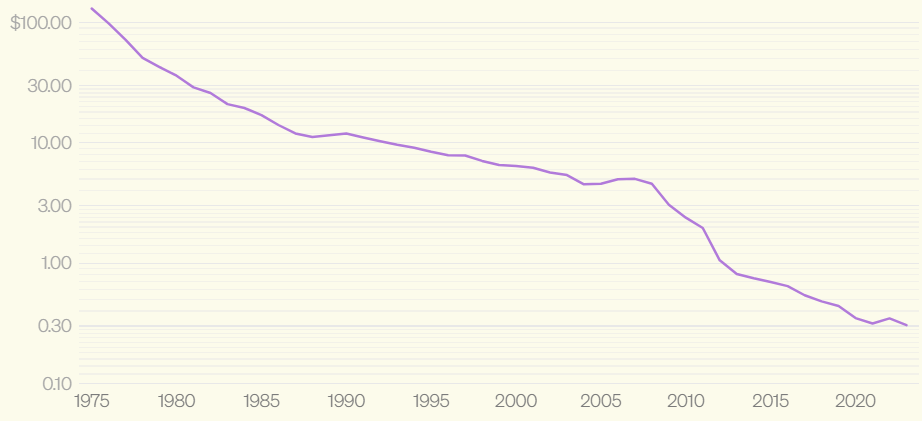

Like most technology-based industries, solar manufacturing experiences steady price declines over time as efficiency improves. First Solar’s average selling price has fallen from 36¢ per watt in 2018 to around 30¢ per watt today, with corresponding reductions in production costs. Importantly, the company includes “technology adders” in its contracts—allowing prices to increase slightly (around 2¢ per watt) as new, higher-performing modules are introduced. Its latest Series 7 panels represent a major leap in performance, achieving up to 550 watts of output and 19.7% efficiency, compared with 125 watts and 17% efficiency for older Series 4 modules.

So why can't Chinese players do the same and make CdTe panels?

The global solar industry — especially in China — has spent decades and hundreds of billions of dollars building out an enormous crystalline silicon (c-Si) ecosystem. Every step of that value chain (polysilicon refining, ingot pulling, wafer slicing, cell processing, and module assembly) has been optimized for c-Si. The scale advantage is so massive that it’s extremely difficult for any alternative technology to compete purely on cost without government backing. Switching to CdTe would require entirely new factories, supply chains, and manufacturing know-how — essentially rebuilding the industry from scratch — which few companies are willing or financially able to do.

Cadmium Telluride isn’t as easy to source or process at scale as silicon. Tellurium, one of its main ingredients, is a rare byproduct of copper refining and not widely available. First Solar has spent over 20 years refining proprietary methods to secure, recycle, and process Tellurium efficiently — effectively locking in an early-mover advantage. For new entrants, building this capability would be expensive, time-consuming, and uncertain, especially when silicon remains cheap and abundant.

Furthermore, U.S. solar manufacturing is an extremely tough industry to break into. Building a fully domestic, silicon-based solar module facility from scratch is complex, expensive, and time-consuming — and recent attempts highlight just how difficult it really is. REC Silicon had to shut down its U.S. polysilicon plant in late 2024 after failing quality tests, while CubicPV scrapped plans for its 10GW U.S. facility earlier that year. On top of that, many Chinese solar companies are now classified as “foreign entities of concern,” which disqualifies them from receiving U.S. tax credits under the Inflation Reduction Act. And this advantage only compounds under the recently passed “Big Beautiful Bill”, which preserved the IRA’s manufacturing credits and introduced a 100% upfront capital investment deduction. In plain terms, this means companies can immediately write off the entire cost of building a new manufacturing facility — instead of spreading those deductions over many years. That’s a massive tailwind for builders of new industrial capacity, effectively lowering the after-tax cost of expansion

In contrast, First Solar has been the clear exception — consistently bringing new facilities online on time and on budget. For any new entrant, starting a greenfield silicon plant today would likely take 3–4 years, meaning meaningful capacity wouldn’t arrive until 2028 or 2029 — just as the current tax credits begin to phase out.

Potential Growth Drivers:

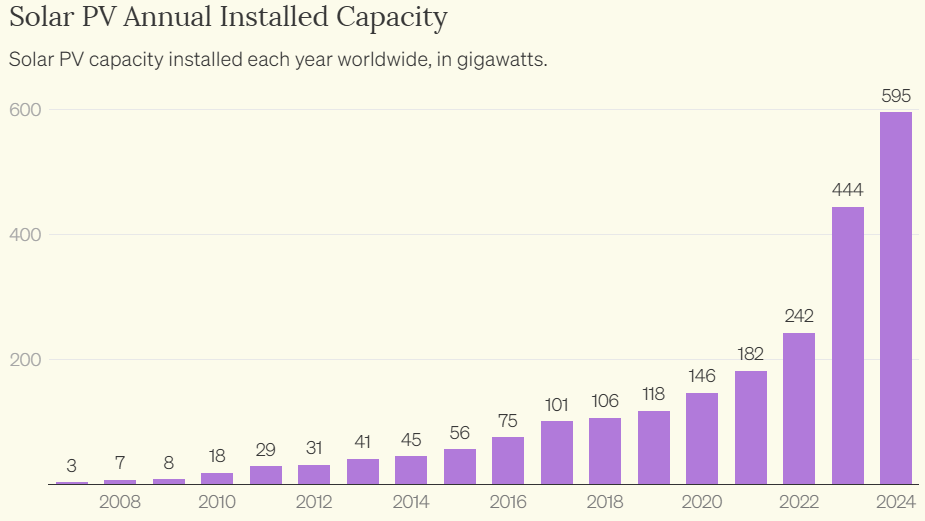

The biggest energy story of the past 15 years has been the rise of solar photovoltaics (solar PV). Although the technology was invented in the 1950s, it wasn’t until the early 2000s that it began to be used at scale for electricity generation, and only in the 2010s did it become a major part of new global generation projects. Since then, solar has expanded faster than any other energy source in history — growing from 100 terawatt-hours of generation to 1,000 in just eight years, compared to 12 years for wind and nuclear, and several decades for fossil fuels.

In the U.S., solar dominates the pipeline of planned new capacity — roughly half of all projects in the interconnection queue are solar-related. Still, in absolute terms, it remains small: as of 2023, solar accounted for around 4% of total electricity generation and less than 1% of total U.S. energy production.

Solar’s future potential hinges on two facts. First, its cost has collapsed — down by a factor of nearly 10,000 since the 1950s, and over 50% just in the last decade — making it one of the cheapest sources of power.

Source: BNEF

BNEF data predicts a massive ramp up of solar capacity in the US with a 12% CAGR from 2023 to 2030 for new GW additions of solar, or 7.2% from 2024 (from 118GW of new capacity in 2020 to 351GW in 2023, 500GW expected in 2024 to >750GW in 2030 and 1000GW in 2035).

Second, it’s intermittent, generating power only when the sun is shining. The debate now is whether this intermittency fundamentally caps solar’s share of the energy mix, or whether continued cost declines in both panels and storage will make it cheap enough to offset that limitation through overbuilding and storage. Early modeling suggests the latter: even with significant overcapacity, ongoing cost reductions could allow solar to provide a large share of total energy at prices comparable to or below today’s electricity costs.

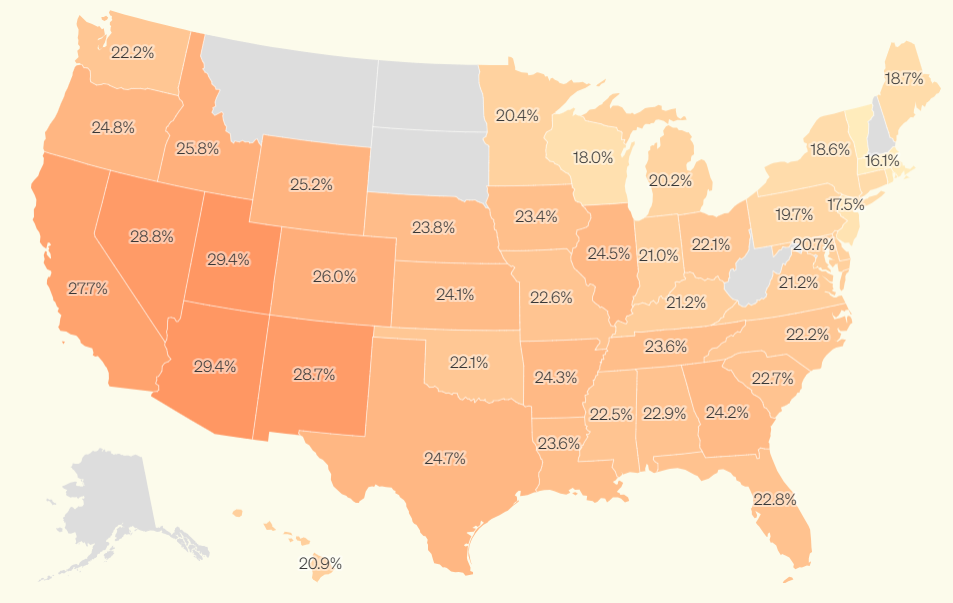

Source: Berkeley National Lab

Lastly, a major new driver of demand comes from AI data centers — which are growing so rapidly that their attitude toward energy is essentially, “we don’t care what kind it is, we just need more of it.” Since the adoption and scaling of GPT's - sell-side analysts have consistently under-forecasted the capex of hyperscalers (meaning how much data center capacity they were building) which have been revised upwards non stop.

In its Q125 call, management noted that U.S. power consumption is projected to grow around 3% per year through the end of the decade, with data centers driving roughly 60% of that increase due to the energy demands of AI training and inference. McKinsey has identified power availability as the top challenge for new data center development, and there have been reports of hyperscalers attempting to restart nuclear reactors to meet demand. Adding a new nuclear reactor takes over eight years, and conventional power plants take five or more years, whereas a solar farm can be planned and built in 8–18 months. If the solar installation is dedicated to a single data center, it does not even need to feed into the broader U.S. power grid. First Solar has indicated that it expects to be the preferred supplier for these projects, as it is the only U.S.-based company that designs and manufactures solar modules domestically.

Addressing the TRUMP risk:

There’s been a lot of concern that a Trump administration might roll back the Inflation Reduction Act (IRA), and that’s one of the reasons First Solar’s stock has sold off recently. But in my view, it would be very difficult — and politically risky — for Trump to go after the specific manufacturing tax credits that benefit First Solar. There are several reasons why I think that’s the case.

First, renewables are now the backbone of new U.S. power capacity. Roughly 80% of all projects sitting in the interconnection queue are solar or wind. If those incentives were pulled, new generation would slow dramatically, power prices would spike, and inflation would rise — exactly the kind of economic pressure that would be politically damaging for any administration. At this point, renewables aren’t just a “green” policy; they’re part of the broader effort to stabilize U.S. energy prices and keep inflation in check.

In fact, when Trump signed the One Big Beautiful Bill (OBBB) on July 4, 2025, it effectively resolved that uncertainty. Markets had feared a repeal or reduction of solar-related tax credits — which would’ve been devastating. Instead, the OBBB maintained or clarified nearly all the key benefits, and in some cases made them even better defined.

Important Tax Credits Driving Margin Improvement:

- The ITC/PTC (48E/45Y) credits remain the primary incentives for solar and wind developers — First Solar’s core customers. Under the new One Big Beautiful Bill (OBBB), these credits will now phase out earlier, by 2030 instead of 2032, unless developers commit capital within 12 months of the bill’s passage and complete projects within four years. This effectively pulls forward investment, as developers rush to “safe harbor” their projects and lock in benefits. As a result, I expect a near-term surge in solar project starts through 2029, benefiting equipment suppliers like First Solar before demand normalizes in the early 2030s.

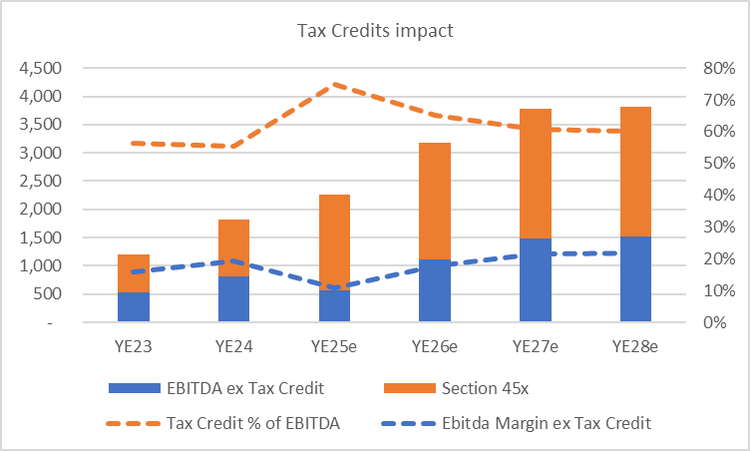

- The Manufacturing Tax Credit (45X) is the real engine of First Solar’s advantage. It gives U.S. producers a fixed, per-unit incentive — roughly $0.07/W for modules, with vertically integrated players like First Solar able to stack credits up to $0.17/W. These credits remain unchanged under the OBBB, with the same 2032 phase-out schedule and continued transferability. This effectively secures First Solar’s cost advantage and margin visibility for the next seven years, while limiting competition from lower-cost Asian imports that can’t access these incentives.

- Finally, the new FEOC restrictions ensure that Chinese-linked companies don’t benefit from U.S. clean-energy subsidies. Starting in 2026, projects must meet strict limits on foreign component content — dropping from 40% to 30% by 2030 — and firms with significant Chinese ownership or leadership are excluded entirely. This effectively walls off U.S. tax incentives from Chinese manufacturers and cements First Solar’s status as the only fully domestic, large-scale solar producer positioned to capture the full suite of government benefits.

Second, Trump has never had the same hostility toward solar that he’s shown toward EVs or offshore wind. He’s already scrapped the EV tax credits and paused new federal offshore wind leases — both key IRA programs — but he hasn’t yet touched solar. That tells me he doesn’t see solar as politically toxic the way he does with EVs, which have become a cultural flashpoint.

Lastly, First Solar is a huge U.S. job creator — and those jobs are concentrated in Republican states. The company’s major facilities are in Ohio, Alabama, and Louisiana, all of which have benefited from the IRA’s incentives. If Trump were to repeal the solar tax credits, it would directly destroy manufacturing jobs in red states — something that goes completely against his “America First” and pro-manufacturing platform.

Final Thoughts:

FSLR's business and that of US solar has picked up since the inception of the IRA, and the case here is that FSLR stands to continue to benefit despite the headlines related to moving away from "green" investments.

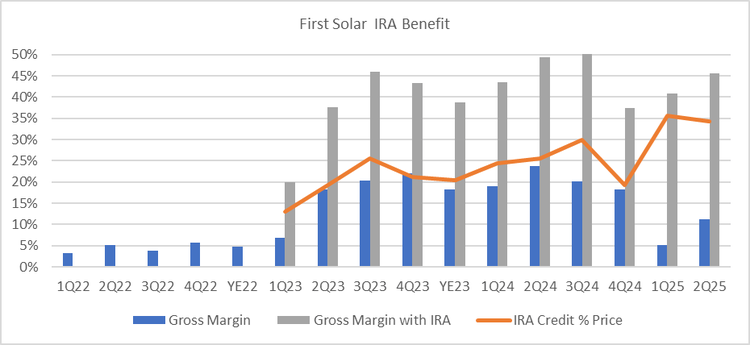

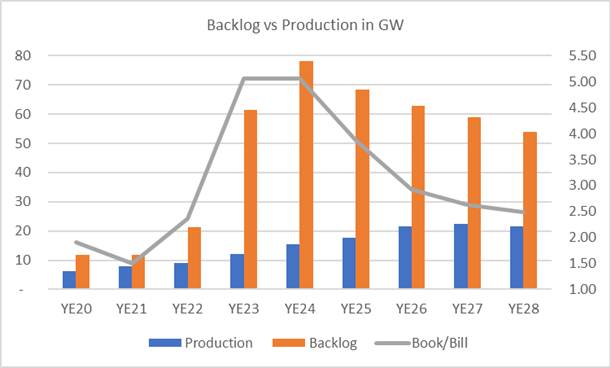

Looking at the charts below - you can see the difference it has made, and more recently, with uncertainty towards what the Big Beautiful Bill will do, I believe FSLR is still favored to benefit towards 2030.

First Solar’s near-term setup reflects a powerful mix of accelerating revenue, expanding cash flow, and policy-driven uncertainty that will shape how management allocates capital over the next several years (2025 - 2030). Revenue is expected to grow over 25% in 2025 and another 18% in 2026, driven by new U.S. factory ramps and sustained demand from utility-scale developers and data center projects. As per management; this growth, paired with moderating capex, should lift free cash flow above $1 billion in 2026 and closer to $2 billion in 2027, pushing net cash toward $5 billion and positioning the company for an important decision: whether to return cash to shareholders through buybacks or dividends, or to preserve liquidity in the face of volatile trade and tax policy.

As well, they will continue to be given the 45X manufacturing tax credits, which alone will provide more than $1.6 billion in cash in 2025 and $2.15 billion in 2026—payments that can either be received directly from the government or sold for roughly 97% of face value—First Solar is on track to hold more than $10 billion in cash by 2028, equivalent to over half its current market cap. On top of this, lets do some napkin math:

If we maintain the multiple of ~15x currently, and grow the eps of 12.07 at end of 2024 by ~15% (through to 2028) - this is conservative -->

2025 EPS: 13.9 x 15 = $208

2026 EPS: 16.0 x 15 = $240

2027 EPS: 18.4 x 15 = $276

2028 EPS: 21.1 x 15 = $317

* the above also does not consider that mulitples expand from 15x --> obviously, if it went to 18-20x then, it is beyond an attractive investment, but even here, it seems like there is a decent risk/reward outcome *

Historically, First Solar has shown discipline in adapting to volatility: after the 2018 supply glut caused by Chinese policy changes and collapsing prices, it exited the Systems business to focus purely on high-value module manufacturing. The pandemic and 2022 inflationary shock temporarily crushed margins, but the company responded by localizing production and securing freight adjusters, which helped rebuild gross margins from 2–3% in 2022 to 50–60% today and EBIT margins in the 40–50% range—making it one of the most profitable manufacturers globally. Supported by IRA incentives and growing U.S. demand for domestic modules, pricing has firmed to roughly $0.30/W, while its massive 68 GW backlog, sold out through 2026 and mostly into 2027, gives the company the ability to be selective with new orders and sustain premium pricing. Despite strong fundamentals, 2025 guidance was cut sharply as management took a highly conservative stance on tariffs, assuming wide-ranging outcomes from the current 10% base tariff to potential 25–46% reciprocal rates on production from Malaysia, India, and Vietnam. At the midpoint, this would reduce 2025 EPS from $17–20 to $12.50–17.50 and revenue from $5.3–5.8 billion to $4.5–5.5 billion, largely due to lower international utilization and added costs from shifting production to the U.S. I believe the low-end scenario is overly cautious, as prolonged high tariffs would have damaging consequences for U.S. energy infrastructure—raising project costs, delaying power generation, and slowing datacenter development at a time when AI is driving massive electricity demand. FEOC restrictions already prevent customers from sourcing low-cost Chinese modules, so policy overreach would only worsen supply bottlenecks. In my view, trade negotiations with India and Vietnam are more likely to bring tariffs back to 0%, which could restore EPS toward the $18 range as underutilization and import costs normalize. Until that happens, volatility will persist, but any positive tariff development should lead to a meaningful re-rating of the stock. It’s also worth noting that most of First Solar’s international contracts contain tariff-sharing clauses that force both sides to renegotiate if rates change; about 12 GW of the company’s 66 GW backlog is exposed to this repricing risk. Taken together, First Solar is in an exceptionally strong operational and financial position—backed by structural policy incentives, unmatched domestic scale, and strong pricing power—but its near-term valuation and capital allocation direction will hinge on tariff clarity and management’s willingness to deploy or return its rapidly expanding cash reserves.

RISKS:

While First Solar’s core business model is structurally positioned to benefit from tariffs and onshoring trends—given its U.S. manufacturing base and insulation from Chinese supply chains—it’s important to recognize that tariffs can still indirectly raise costs. Higher import duties on materials and components can inflate the dollar value of capex for factory buildouts and equipment, even if those expenses are ultimately deductible or offset by tax credits. In other words, tariffs support pricing and competitiveness at the revenue line but can simultaneously pressure margins and cash outflows on the cost side.

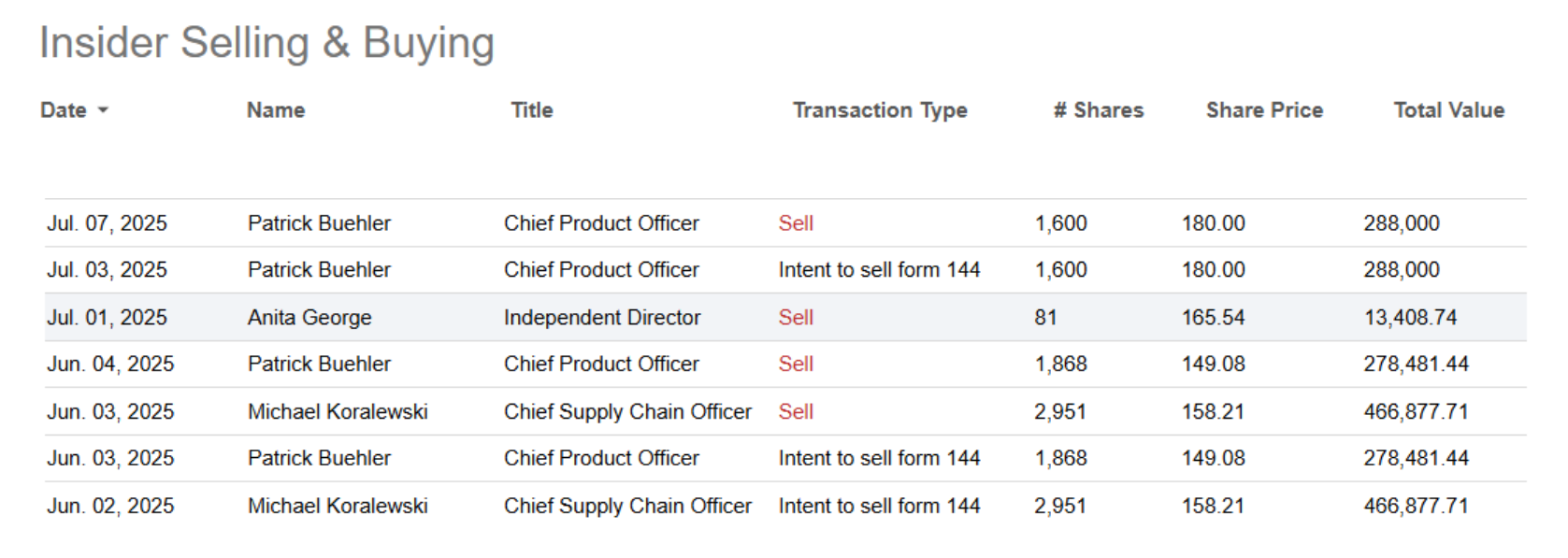

Additionally, insider activity warrants a note of caution. There has been a steady level of insider selling in recent months. While much of this likely reflects the exercising of stock options rather than outright liquidation, the lack of any insider buying stands out.

Disclaimer

I do not own shares of FSLR.

This blog (aka "coconutgrapefruit") is for informational and educational purposes only and does not constitute investment advice. I am not a licensed financial advisor. All views are my own and based on personal research, which may be incomplete or inaccurate.

Investing involves risk. Always do your own due diligence or consult a professional before making any investment decisions. I may hold positions in securities mentioned.