Consumer Discretionary - A Quick Rebound

12.05.25

For most of this year, the story was simple: tech and AI up and other sectors struggled. In particular, Healthcare and consumer discretionary both went through brutal drawdowns. Earlier in the year I pointed out that healthcare and biotech were starting to quietly outperform tech from deeply depressed levels and has since recovered to an extent. But, Consumer discretionary, not so much - that is until in the last few weeks.

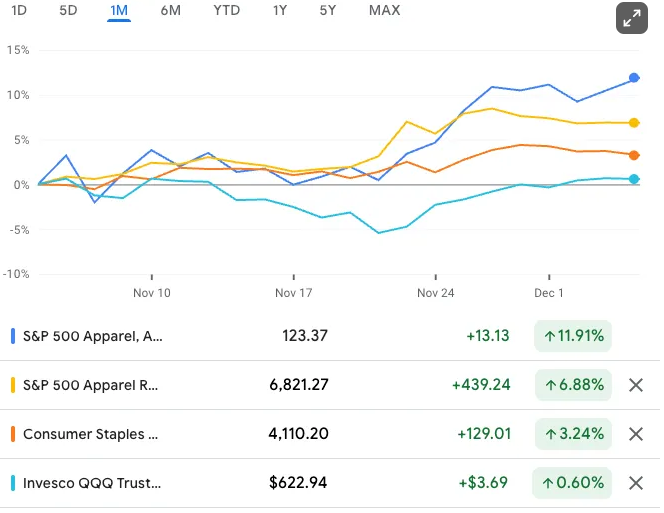

The S&P 500 Apparel & Luxury Goods Index has risen higher in the past month.

The S&P 500 Apparel Retail Index is also solidly positive over the same period.

Meanwhile, the tech-heavy QQQ has more or less chopped sideways in comparison.

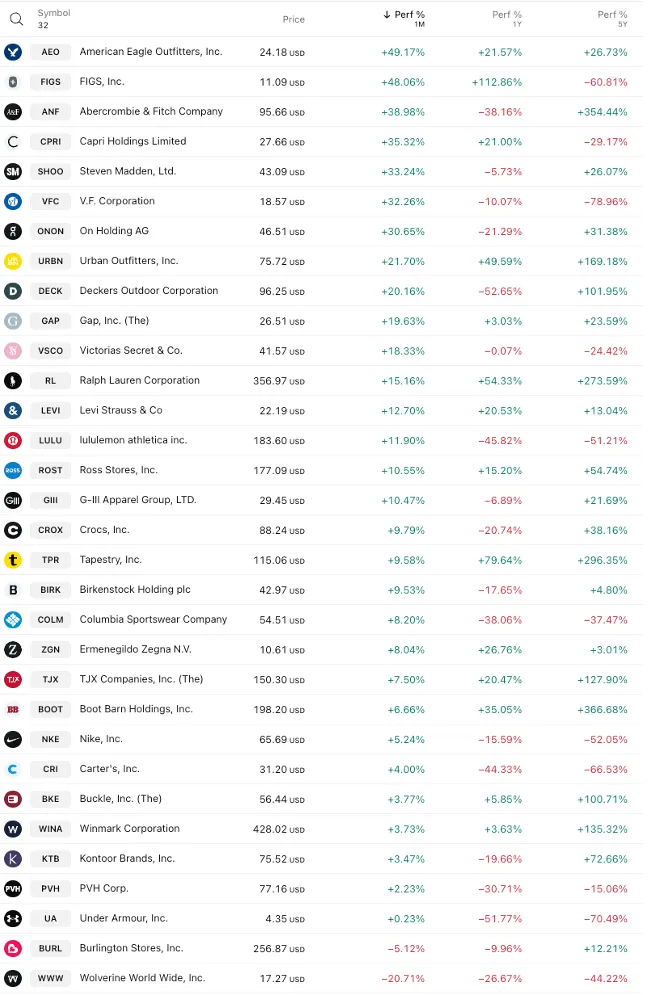

It’s not just the indices, either. Footwear has been particularly strong - see below:

As I’ve been working on deep dives on some names like Nike, Deckers, and Lululemon, the retail stocks have been moving fast that the numbers on my screen could go stale before I finish. As you can see above, price action is often faster than the my research process. By the time I publish the full deep dives, likely a few weeks from now, it’s entirely possible that some of the moves I’m describing here will already be reflected in the stocks.

But what I am not trying to do is to call the stock price accurately, but rather highlight that the apparel and footwear space could start to mean revert off the repressed levels quickly. At the same time - emphasize that what really matters is the underlying framework: how these businesses make money, where their real risks are, and what has to go right (or wrong) from here.

Stay toned!