Bruker Corp. $BRKR Part 1/3

08.25.25

I first came across this business while looking at the Waters Corporation a few years back, and I wanted to look more into it before. However, recently as I was doing my medtech filters - this business came up and it has dropped ~35% this year alone, along with the healthcare sell offs. Now this doesn't mean it is a opportunity, but I remember BRKR being a high quality business with very niche verticals that they sell towards.

Interestingly, I also saw that in the most recent 13F - Michael Burry of Scion Asset Management bought a sizable amount:

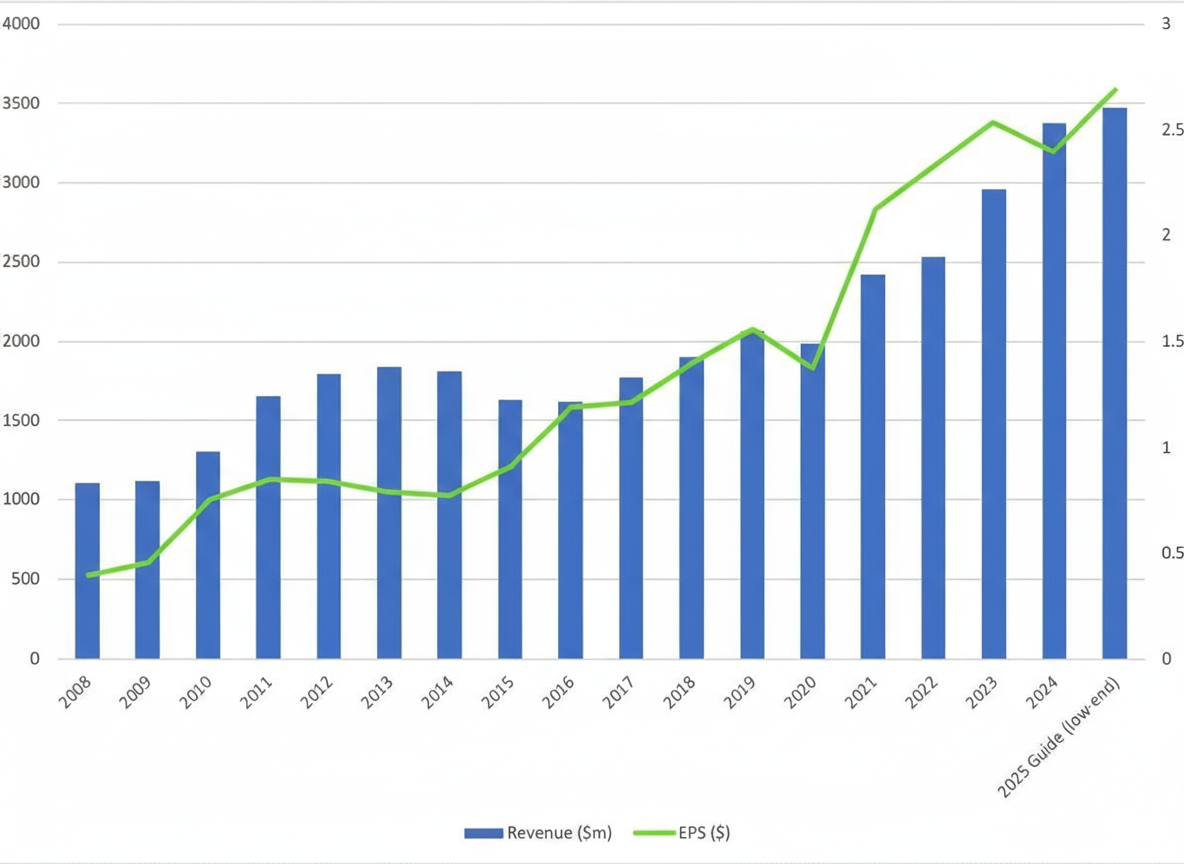

Hence, for this posting, I wanted to dive a bit deeper into the business model and see if there is an interesting opportunity. For reference at ~$34 per share, and it currently trades at a FWD 15x, if you had bought it back in 2012 at the same multiple - it would have ~20% compounded from then until 2018, and eps grew at low double digits.

Loss of investor confidence explained:

First, the company has made some risky bets via acquistion where it is dilutive to earnings, however the upside is that if these acquistions work-out- it really benefits to strengthen Bruker's portfolio and long-term positioning.

NanoString acquisition thesis, here is an excerpt from a recent interview with management.

LeMieux: Why did Bruker acquire NanoString?

Munch: We saw three really good platforms and really good people who had deep expertise in those platforms. The CosMX has always led in plex, and we see that continuing. And the GeoMX shouldn’t be overlooked because it is the only platform that can do whole transcriptome and 577 proteins. There’s nothing on the planet that can do that level of multiomics for region of interest-based exploration. And with the nCounter, which is the oldest of the platforms, we saw a whole new set of assays that we can develop and bring to market. So those three platforms are really strong.

When we first went into it, we thought, wow, those platforms are pretty strong. This is a really good business decision. And then the more due diligence we did, we said, wow, the people who understand those platforms are great people.

There is a solid business decision behind doing this; there is a good ROIC (Return on Invested Capital) on the acquisition. But there is another piece, which is that this is the best move for science. Keeping these platforms alive and going is super important to us. I think it would have been a shame for these not to continue. And we think Bruker was the best home for these to continue. That’s it in a nutshell.

the company made two strategic but loss-making acquisitions — one in late 2023 and another in mid-2024. Both deals are guided to be EPS-dilutive through 2026 before turning neutral and eventually accretive. While these acquisitions are intended to strengthen Bruker’s long-term positioning, they have pushed the company off the medium-term earnings trajectory it outlined at its 2023 Investor Day.

Second, there is growing concern around U.S. government research funding. The National Institutes of Health (NIH) recently announced cuts to its grants, and the broader outlook for NIH’s budget remains uncertain. Given Bruker’s above-average exposure to academic and government end markets, these developments have reignited short-seller activity — a familiar pattern whenever NIH funding comes into question.

Third, new U.S. border tariffs and the risk of retaliatory trade measures have added another layer of anxiety. These policies could disrupt supply chains, increase costs, and weigh on demand from international research institutions. The political volatility associated with a new U.S. administration only amplifies the uncertainty.

Lastly, investors worry Bruker may have to revise or withdraw its annual guidance, even though preliminary Q1 revenue came in better than expected. Combined with the perception that its controlling shareholder-CEO prioritizes long-term strategic goals over near-term profitability, sentiment has turned cautious.

Investment Thesis:

Bruker (BRKR) makes very specialized scientific instruments—like advanced NMR machines and mass spectrometers—that scientists use for cutting-edge research in fields such as cell biology and genomics. Many of these are one-of-a-kind or highly specialized tools, built for the unique needs of leading research labs and universities.

Bruker is a company that has built its reputation over six decades by being the world leader in advanced scientific instruments — tools that help researchers and scientists push the boundaries of biology, chemistry, and materials science. Its moat is rooted in constant innovation and deep scientific credibility. Few companies have sustained technical leadership in such complex fields for as long as Bruker has.

From the very beginning, Bruker has worked hand-in-hand with top researchers — from Nobel laureate Richard Ernst (the person who developed NMR machines) in the 1960s to Matthias Mann today.

**NMR (Nuclear Magnetic Resonance) - uses magnets and radio waves to study the chemical or physical properties of an molecule. They are used in many day to day applications - from drug discovery (3D structures), MRI machines, airport security (to scan the body and bags), food testing, environmental studies etc.

These close collaborations allow Bruker to stay ahead of scientific trends and develop products years before competitors see the opportunity. This tight feedback loop between academia and industry remains the foundation of its innovation engine.

The company’s culture is unusually entrepreneurial for its size. It encourages curiosity, technical ambition, and a willingness to take calculated risks — what Ernst once called “inventive entrepreneurship.” That mindset has kept Bruker agile and creative, even as it has scaled globally.

Leadership is another key strength. Bruker’s CEO combines deep scientific training with operational discipline and capital allocation skill — a rare combination in this space. The family’s continued control gives the company stability and freedom to execute a long-term strategy, without bending to short-term market pressures. They tend to operate with the mind set of "for scientists by scientist" and steer away from non-technical leadership.

Financially, Bruker’s decade-long transformation has paid off. After a long restructuring phase, operating margins have expanded by roughly 10 percentage points since 2014. While recent acquisitions have temporarily diluted profitability, management expects continued improvement of more than 1.25 percentage points per year through 2027, with additional upside beyond that. Organic growth is targeted to exceed the broader life-science tools market by about 200 basis points, reflecting both strong execution and product leadership.

Today, Bruker holds the #1 or #2 position in around 70% of its product lines, and in some areas — such as ultra-high-field NMR — it’s effectively the sole player. Its instruments are critical to fast-growing areas like proteomics, spatial biology, semiconductors, and nuclear fusion, providing exposure to some of the most important scientific frontiers of the coming decade.

Historic Context:

To truely appreciate the business, its important to highlight the long-history of BRKR, and why its formation since the 1960s has led to them doing what they do and how specialized they are - it goes all the way back to Germany and Switzerland, where they where the world leaders for pharmaceutical development, and arguably still does today.

1960–1990s: The Beginnings — Founding & Scientific Roots

- 1960: Bruker-Physik AG founded by Günther Laukien and Dr. Emil Bruker in Karlsruhe, Germany.

- 1963: Launch of Bruker’s first NMR pulse spectrometer — the company’s commercial breakthrough.

- 1965: Acquisition of Swiss firm Trüb Täuber’s NMR operations → creation of Spectrospin AG, adding top talent and strengthening R&D links with ETH Zurich.

- 1980s: Expansion into MRI, infrared and Raman spectroscopy, and mass spectrometry.

This period established Bruker’s scientific credibility and culture of innovation rooted in academia. It defined Bruker’s DNA — deep physics-based expertise and close collaboration with the research community. The firm became a global leader in analytical instruments and built the foundation for its long-term brand reputation: “innovation with integrity.”

1991–2008: From Family Network to Unified Company

- 1991: Bruker Federal Systems Corporation founded in Massachusetts — the precursor to today’s BRKR (public entity).

- 1997: Founder Günther Laukien passes away; ownership transferred among family members.

- 1997: Acquisition of Siemens’ analytical X-ray division (AXS).

- Multiple reorganizations and internal share transactions among the Laukien family.

- Frank Laukien (Günther’s son) consolidates control and becomes the long-term CEO.

This was a transitional and complex phase where the fragmented Bruker ecosystem — multiple semi-independent entities — began converging. It was messy legally and structurally, but crucial for evolving Bruker from a loose family network into a single cohesive organization. Frank’s emergence as the controlling shareholder-CEO also set the stage for a long-term strategic vision anchored in both science and business discipline.

2009–2014: The Formation of the Bruker Management Process (BMP)

- Post-GFC slowdown exposes inefficiencies across Bruker’s units.

- 2009: Agilent acquires Varian → Bruker picks up divested Varian assets, but many prove unprofitable.

- 2010–2014: Major restructuring — divestiture of underperforming assets, consolidation of manufacturing, ERP implementation.

- 2014: Formalization of the Bruker Management Process (BMP), a system of operational excellence and continuous improvement.

This was the turning point where Bruker transitioned from a collection of labs to a modern industrial operator. The BMP gave Bruker the internal discipline comparable to Danaher’s DBS or Thermo’s PPI systems — essential for scaling profitably. It institutionalized efficiency, margin expansion, and integration rigor across divisions.

2015–2018: Project Accelerate — Getting Back into a Stride

- Operational and margin recovery gains traction.

- Launch of new platforms such as timsTOF (2016).

- 2017: Internal identification of high-growth areas (“Project Accelerate”).

- 2018: Public introduction of “Project Accelerate” strategy.

After a decade of internal clean-up, Bruker starts to play offense again. Project Accelerate marked the shift from stabilization to growth, focusing resources on high-ROIC, high-margin, science-driven markets like proteomics, microbiology, and materials analysis. The company’s culture of entrepreneurial science, backed by process discipline, began to bear financial fruit.

2019–2021: Project Accelerate 2.0 — Scaling Innovation

- 2019 Investor Day: First full public presentation of Accelerate roadmap (6 growth areas, >40% of revenue).

- 2021: Launch of Project Accelerate 2.0, expanding into proteomics, multiomics, and spatial biology.

- Strengthening of leadership team: Busse (BioSpin), Munch (NANO), Srega (CALID), Herman (CFO).

This phase represents Bruker’s strategic pivot toward the life sciences frontier. By focusing on multiomics and spatial biology, Bruker positioned itself at the intersection of advanced instrumentation and biomedical discovery — a secular growth opportunity. The strategy also reinforced the company's differentiation from “industrial” peers like Thermo, leaning into deep-science innovation.

2023–2024: Strategic Acquisitions & Short-Term Pain

- Late 2023: Acquisition of PhenomeX, a loss-making but strategic single-cell analysis company (bargain purchase gain recognized).

- Mid 2024: Acquisition of NanoString assets out of bankruptcy — expanding into spatial biology.

- Both deals EPS-dilutive through 2026, expected to turn accretive thereafter.

This is where we are at today and hence the investor confidence about these acquistions - These deals fit the Accelerate 2.0 vision but temporarily weigh on financial optics, creating the narrative of “near-term pain, long-term gain.” Furthermore, a few things macro-related are also happening:

- NIH grant funding cuts raise concerns over academic demand (a key Bruker end market).

- Rising U.S. tariffs threaten cross-border supply chains.

For the part 2) we will go deeper into what bruker does, why their products are so specialized, and understand the competitive advantages they hold.

Disclaimer

I do own shares of BRKR.

This blog (aka "coconutgrapefruit") is for informational and educational purposes only and does not constitute investment advice. I am not a licensed financial advisor. All views are my own and based on personal research, which may be incomplete or inaccurate.

Investing involves risk. Always do your own due diligence or consult a professional before making any investment decisions. I may hold positions in securities mentioned.