Belimo AG $BEAN part 1/3

06.24.25

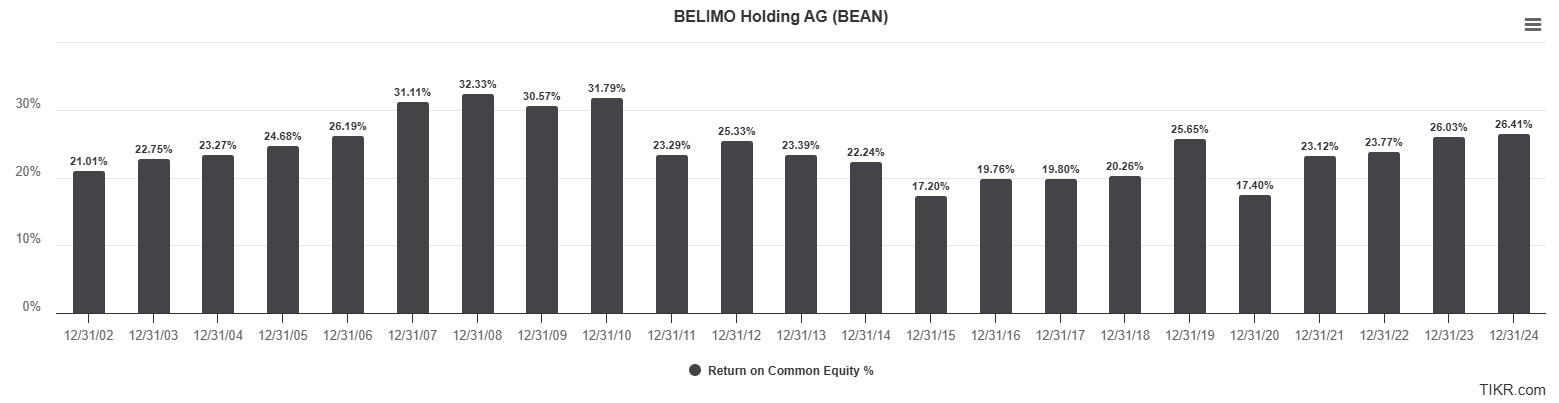

For this month, we are looking at Belimo AG, a small company with incredible ROICs & strong sector tailwinds – in both A.I and Infrastructure retrofitting.

Company Summary:

Founded in 1975 by a group of entrepreneurs and headquartered in Switzerland, Belimo is a global leader in actuator solutions for buildings and HVAC systems. The company primarily serves the non-residential heating, ventilation, and air conditioning (HVAC) market through two core business segments: Air (~50%) and Water (~46%), with a smaller third segment in Sensors and Meters (~5%) – note this small segment has grown quickly from 2%-5% in the last 5 years.

Belimo’s Air segment—its legacy business—focuses on actuator solutions for air regulation within buildings. In this segment, Belimo holds a global market-leading position, with an estimated ~35% share. The Water segment, introduced approximately two decades ago, offers similar actuator systems designed to regulate water flow and has grown rapidly to represent nearly half of total revenue.

One of the most important qualities of this business is its obsessive focus on continuous product improvement. Belimo doesn't just launch a product and move on — it listens closely to customer feedback, incorporates it into the next iteration, and repeats the cycle. This “refine and improve” loop has been deeply embedded in the company’s culture since day one. Remarkably, the original founders still maintain meaningful ownership and remain actively involved, helping preserve this ethos at the highest levels.

What’s particularly impressive is how this commitment to innovation has enabled Belimo to steadily climb the value chain for its customers. It began with air actuators, then expanded into water-based solutions, and now is pushing into sensors and meters. Each move builds on the last — deepening customer integration, increasing switching costs, and expanding the company’s relevance across the entire HVAC system.

At today’s valuations, the business reflects this quality – in addition to the on-going benefits of structural trends such as emissions reduction through energy-efficient buildings, urbanization, digitalization and A.I.

Before I dig deeper into the business, we will examine what an actuator is, the competitive landscape, and where they sits across the value chain.

What Is an Actuator & How It’s Used:

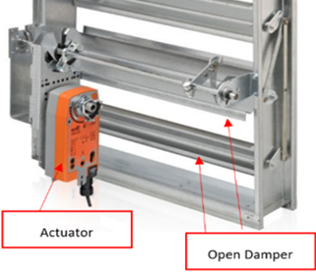

An actuator is a device that causes motion — either in a straight line (linear) or a circular motion (rotary) — by converting energy (pneumatic, electric, or hydraulic) into mechanical movement. They’re found in a wide range of systems, from car seats and automatic doors to the critical infrastructure of HVAC systems, where Belimo specializes.

In HVAC and building automation, actuators are essential for regulating airflow and water flow to maintain indoor climate, safety, and energy efficiency (actuator moves the damper electronically from open to close). The most common application is in damper actuators, which adjust valves or plates within ductwork to control airflow—ranging from fully open to fully closed—thereby maintaining desired temperature, air quality, and ventilation. In a typical commercial building, there may be 15,000–20,000 actuators, each costing $100–$300. Belimo focuses on this segment of the market—smaller, high-precision actuators for HVAC and water systems.

Industry Backdrop:

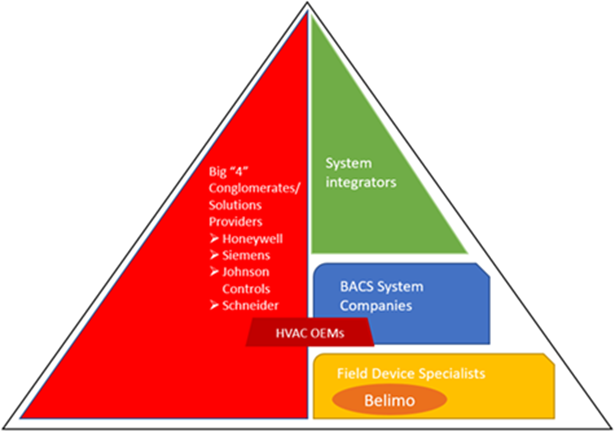

Belimo operates within the broader Building Automation and Control Systems (BACS) industry, a market estimated to exceed $100 billion, growing at a steady 3–4% CAGR. This highly fragmented space is typically divided into three functional layers:

- Management Systems (BMS) – Software platforms that store, control, and analyze building data to optimize performance and decision-making.

- Automation Systems – Digital controllers that gather zone-level data and communicate with the BMS.

- Field Devices – The physical components (e.g., actuators, sensors, valves, switches) that directly interact with HVAC, ventilation, and plumbing systems to execute commands and ensure proper system function.

- Belimo is the market leader in Field Devices, particularly actuators and valves. According to company and sell-side estimates, the addressable market for field-level products is approximately $2.5–3.5 billion. While this is a much smaller percentage of the overall market, it also grows faster at around MSD, according to management.

The BACS value chain includes both contractors/solutions providers and OEM manufacturers. The dominant names in the space are the so-called “Big 4” conglomerates: Honeywell, Siemens, Johnson Controls, and Schneider Electric. These players operate across the entire value chain—from building management systems to automation to field devices, often positioning themselves as one-stop shops for building solutions.

However, their broad focus comes at a cost: they tend to be generalists, with less specialized expertise at the field-device level. This opens the door for niche players like Belimo, who focus entirely on field-level components, delivering superior product quality, specialization (customization), and innovation.

Despite overlapping product offerings, conglomerates and specialists like Belimo often coexist, as customers—particularly OEMs and installers—pull in best-in-class components, even when integrated into broader system offerings from generalists. This push-pull dynamic gives Belimo leverage in influencing demand across the value chain.

What makes Belimo standout?

Belimo is the dominant player in this area with nearly ~30-55% market share (this figure has grown from 25% in the last decade). In Europe, they hold close to ~65%. Other estabolished characteristics of the business include:

- Its sales are nearly 3x larger than the next-largest peer.

- At least one Belimo product is installed in every three non-residential buildings globally.

- It consistently outgrows the industry, delivering high-single-digit growth compared to the sector’s low-single-digit average.

- Belimo holds the #1 global market share in air actuation (~37%), has moved up to #2 or #3 in water actuation (~16%), and holds a growing 3% share in sensors/meters—a category it entered more recently.

- In verticals such as Fire & Safety (actuators used for fire/safety ventilation systems), Belimo commands an estimated 50% share, benefiting from the need for compliance with strict safety regulations, making it a trusted partner for OEMs.

- They sell a portfolio of high ROI products in a global transition towards energy efficiency.

- They can push & pull demand through their end customers by going direct and offering strong value-add incentives in their products' quality, flexibility and delivery.

- Belimo holds an industry-leading Brand & Reputation that they have cultivated through a focus on R&D. They are responsible for inventing newer applications for adjacent fields.

- Lastly, they take a unique approach to managing their suppliers while focusing on their product design, assembly and testing.

We will dive into each of these points further.

While Belimo’s product may seem simple at first glance, some can be very technical, and there are many different types for different applications. In general, think of these products as small devices installed into vents or pipes that ensure whatever is flowing through them (air or Water) is done efficiently (higher efficiency à lower energy usage à cost savings). Because there are different types of systems within a building (HVAC ventilation, boilers, fire & safety, specific zones), actuators are also tailored to a particular function. Below is a glimpse of the different products offered by Belimo:

Air Applications: In 1974, the actuators used for HVAC systems were cumbersome and operated with many metal components (crankarms/rods). These products made the installation time much longer for a technician, as they had to connect the crank arm à pushrods à to the damper etc. Belimo came along and introduced the first direct-coupled damper actuator, which was technically superior and cheaper to make. Instead of connecting these pieces, the technician installed a single product (the Belimo actuator) to the damper, which reduced installation times by a third and made the product the de facto standard for HVAC technicians. This product would revolutionize the way actuators were installed onto air dampers, making Belimo the leader in the space. Today, the Air Applications segment comprises a complete range of products related to airflow control within a commercial building, including; rotary or linear actuators for air dampers, safety solutions, and individual room or zone actuators.

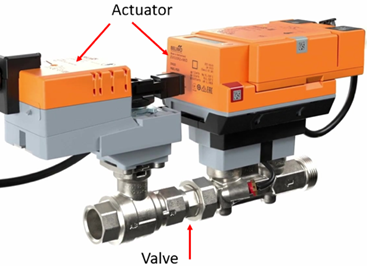

Water Applications: In 1998, by acquiring a Swiss-based company called “Lineg SA” for CHF1.8mn, Belimo entered the Water Application business. Like air actuators, the water business consists of products that control water flow. The products used within this segment generally consist of a valve (many different types depending on the piping – i.e., globe & butterfly) and an actuator that sits on top of the valve to control the flow of water (as it would for a damper, but in this case the valve). When you compare it to the air actuator, the water products are more sophisticated and technical. Instead of selling just the actuator, you also sell the valves accompanying them. Unlike the damper actuator attached to the HVAC system (typically standardized), the water valves must be attached to pipes (non-standardized, depending on how the building is constructed). This means that customization becomes an important offering for Belimo’s customers. While segment margins are not given, I suspect this segment is more profitable and can command higher ASPs. Since the inception of this segment nearly two decades ago, they grew their sales from 3.1% in 1998 to almost half the business (~47%).

Sensors & Metering: In 2017, Belimo entered the sensors and metering segment. The rationale for this decision was to 1) widen its addressable market and 2) round out its portfolio of offerings to complement the other two segments. While their legacy segments control & regulate the flow of air and water, sensors and meters are used to measure the physical properties like temperature, humidity, and air quality within the same building or system. These are all similar niches that are likely to be sold into the same verticals, intending to save on energy costs while providing adequate air quality & comfort. Management targeted 3-5% of sales by 2022 when this segment was introduced, and since then, they have met this target at 3% of sales last year.

Belimo Sells a High ROI Product:

As actuators cost a fraction compared to building management systems, they can be considered the low-hanging fruit with a high return on investment. The typical payback period for a Belimo product is around ~2-3 years, with associated energy-related savings of ~40% annually. Hence, when it comes to Belimo’s line of products, customers are much less price-sensitive and are generally looking for the best products available. For example, in the case of an OEM, it is more economical for them to purchase from Belimo instead of making their own. A Belimo actuator costs $100-300 dollars compared to an HVAC system or boiler system that could be north of ~$20,000-$100,000, the time and effort used for R&D to develop their own could be spent elsewhere (Ex. Carrier Revenue $20bn vs Belimo’s <$1bn).

Belimo’s End Markets:

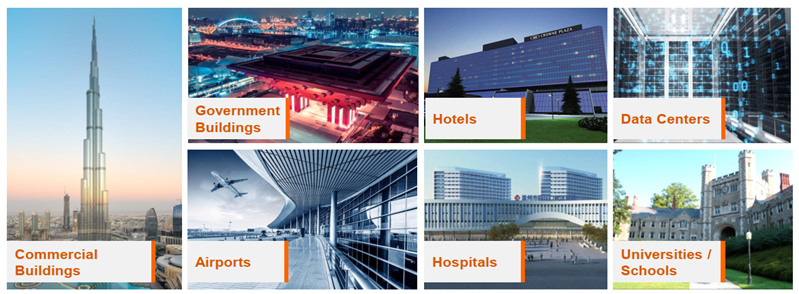

Belimo's end markets are predominantly all buildings that are not single-family homes. It ranges from medium to large commercial buildings, multi-family apartments, and industrial complexes with sophisticated HVAC systems, representing ~95% of their sales (~70% commercial, ~20% infrastructure, and ~5% data centers). In the last decade, through the rise of 5G networks, higher demand for cloud services and the focus on making indoor environments healthier (i.e., COVID), more commercial facilities have demanded Belimo’s products. In particular, management has noted that data centers and healthcare facilities have garnered more attraction in recent years. With a lower base of around ~5%, I would expect more runway ahead, given the general growth in technology. The rest of their sales (~5% residential buildings) come from smaller businesses in district heating, single-family homes, trains, and cruise ships. The limited size in this vertical is because the projects are generally much smaller than a commercial one (a few actuators vs tens of thousands). While this breakdown has remained similar in the last decade, Belimo has hinted that they are trying to push into the residential/single-family homes with newer product offerings (i.e., sensors could be an example).

This ~95% is further broken down by ~40% from new construction, ~40% to major refurbishment projects and ~20% towards retrofitting. Refurbishment projects combined with retrofitting may overlap and be considered new projects, given that most will use brand-new Belimo actuators with old HVAC systems. Depending on the size of the project, the number of actuators (including water valves) can range from a few hundred to tens of thousands. For example, a new building complex in California used more than 20,000 Belimo actuators and valves combined. Because the split among these end markets is diverse, Belimo lends itself to being protected when the economy becomes more cyclical. When there is a pause or downturn in new construction, its business can be buffered by the retrofit & refurbishment demand (including replacing aging actuators of the install base).

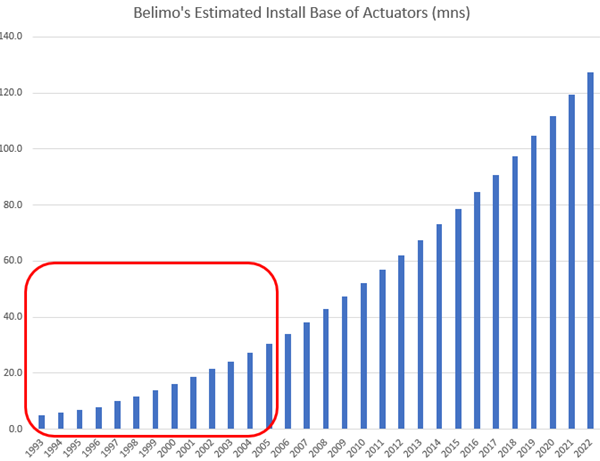

Belimo’s actuators typically have a life cycle of ~15-20 years, with ones related to fire & safety requiring more frequent changes (the risk of failure is higher). Currently, there are ~120mn actuators installed in the field, of which, using conservative estimates, ~30mn are 20yrs of age or older. Assuming its lifecycle, the ones from 1998-2005 could be on their way to being replaced, which amounts to an estimated ~13mn actuators. With Belimo shipping ~8mn per year, this is ~1.6X their annual shipments, which means there is a margin of safety in case of a slowdown in new construction.

Who are Belimo’s Customers:

Belimo’s customers fall into two categories, “Contractor” and “OEM” channels, representing ~55% and ~45% of their sales, respectively. As mentioned, the contracting channel is highly fragmented, ranging from large system integrators (like the “Big 4” in Honeywell, Siemens, Johnson Controls & Schneider) that will offer a range of solutions across the building management vertical to smaller, regionally active distributors and commercial parts wholesalers. Conversely, the OEM channel is comprised of manufacturers (i.e., like a Carrier) that make the vents, air units, boilers, dampers, etc., and use Belimo products to finish their offerings. Relative to Belimo, both of these customer groups also have some overlap in their offerings that compete directly with Belimo. The reason that they buy from Belimo is not necessarily of their choosing but rather what is demanded by their customers. Belimo’s customers can be organized via the “influencer” group and the end customer. Typically, the end customer is the real-estate owner or developer who hires the “influencer” group as a general contractor, architect, planner and consulting engineer that commissions a project. This influencer group then dictates what products & systems to buy from the contractors or OEMs. For example, they might choose a Honeywell building management system but request that all actuators are from Belimo.

A customer-oriented focus to Push & Pull Demand:

- Strong customer education via Direct-sales: Belimo fits into the above equation because, through its 30 local subsidiaries across 23 countries, its sales force is regionally organized into two direct channels, with one focusing on the contractors & OEMs and another on influencers. More than ~30% of their employer workforce is dedicated to sales. By being a pure-play, Belimo’s sales force is better at educating their customer groups, as they have a deeper HVAC application knowledge regarding field devices, compared to peers (i.e., the “big 4”), where their sales reps have a more generalized knowledge base as they are selling across the vertical (i.e., the BMS, Controllers & Devices). Nearly 1/3rd of their employees are tied to sales, marketing & distribution. Through what they call the “Belimo University,” technicians or field workers can access free HVAC education, training and certification. These include webinars, personal consultation on-site by a Belimo sales manager, and professional development courses. All customer interactions are managed through a Customer Relationship Management tool. I would suspect that a technician trained using a Belimo product is more likely to stick with them throughout their careers, but it also allows them to build longer relationships for the replacement business and drive the pull-through demand.

- Fast Delivery Times: For products that are made to be ordered, Belimo tries to adhere to a 48-hour delivery schedule, compared to competitors that can take up to a few weeks.

- Ease of Product Selection: Compared to competitors' websites/online presence, Belimo’s is much more user-friendly and intuitive. Their “SelectPro Online” catalogue guides customers based on their needed parameters. Simply, insert the specification of the damper type, width, height and torque, and it will populate the correct actuator needed. This is in contrast to their peers that need the customer to identify and search for the specific product through its online product pages or via PDF catalogue.

- Product replacements for all of their competitor's defective products. Belimo replaces all of their major competitor's defective products (including Honeywell, Johnson Controls, Siemens, Invensys, and more). Through their “SelectPro,” Belimo lists all of their competitor's products, where you can select the specific one (i.e., Honeywell or Siemens), and the Belimo equivalent would be shown to the customer, and they could replace it free of charge.

- Customization & Solutions offering: When new building projects are commissioned, the orders from OEMs and contractors, depending on the size, can range from thousands to tens of thousands of actuators required. This means that HVAC systems, boilers, pipes and ventilation of different sizes must also be fitted with the correct ones. Belimo can offer flexibility for its customers through customization. According to one sell-side analyst, most of their field devices are customized to regional standards, allowing customers with different actuation needs to view Belimo as the one-stop shop. In this view, not only can they offer actuators, but adding water valves & sensors to the overall solution also enhances their value-add proposition.

- Customer-support & Warranty: Relative to their peers, Belimo also has one of the strongest customer support channels in the industry. Technicians needing support can get access by calling their local channels, through their cloud platform or having an on-site visit by a Belimo specialist. Furthermore, Belimo has one of the longest product warranties in the industry, lasting 5yrs + 2 if they connect their products to the Belimo cloud, compared to competitors that offer 3-5 years.

Brand & Reputation:

Within the building automation industry, when it comes to actuation, Belimo has made itself the number one partner. Recognized for their orange outer shell, Belimo's actuators have been praised by contractors, distributors, and technicians as the de-facto product for actuation. Simply googling “HVAC actuators” will showcase mainly Belimo ones. Nearly all the technician tutorials on youtube, seminars for HVAC certifications and professional courses are taught using Belimo products. Their products can be found in some of the most recognized buildings around the world, such as; The White House, Bundestag (Berlin), Kremlin (Moscow), Burj Khalifa (Dubai), One World Trade Center (New York), Prime Tower (Zurich), Zurich and Hong Kong airports, Apple, Tesla and Google headquarters. I would presume that working with these big names creates an easier avenue for when they get new customers.

Innovation:

Since its inception, Belimo has dedicated much effort toward its R&D and centered its business around innovation. In the last two decades, they have spent an average of 6-8% of their net sales on R&D. Compared to their peers and the industry; this is one of the highest, especially for the niche they operate in. What has made Belimo stand out relative to peers is its ability to introduce newer products to the market quickly and its ergonomic product design that allows for easy installation and integration for the technicians. Through this, they have continuously churned their product portfolio and have ~10-15% of their annual sales dedicated to products three years or younger and, on average (in the last decade), have commanded a 1-2% sales growth through pricing (in 2022, 11.9% organic growth in sales, 6.1% was from pricing). Below are two examples of their innovations:

- Belimo’s energy valve (water applications segment) is the industry-leading product for water actuation. It was the first product with a built-in sensor and integrated intelligence. The difference between this and an air actuator is that it needs to be more technical when measuring water pressure within a valve (more difficult to achieve). Within the device, Belimo offers NFC technology, which allows devices to share data nearby without being connected to power (common amongst other products on the market). Other technology benefits are:

- Data analysis and storage (13 months),

- Connectivity through BACnet & Cloud (building management systems),

- Power through ethernet (use one power cord that offers both power & wifi),

- These offerings enable technicians to reduce service costs & installation times.

- For example, the actuators, valves and sensors must be well-fitted together to deliver the highest efficiency level, reducing operating costs. One of their clients mentioned that cost savings from properly fitting these valves could have annual savings north of $20,000. Belimo claims that their damper actuators and valves consume up to 80% less energy than similar products.

Belimo’s fire & safety actuators are specialized actuators used to help close vents in the case of a fire, which seal air ventilation for individual zones to prevent fire from escaping. Belimo has ensured they are designed to withstand temperatures of ~175 °C and can be remotely controlled from a central point. Or, in the case of power outages (potentially caused by fire) actuator will default to a spring mechanism instead of electricity. From a maintenance perspective, it lowers the cost of operations, as you can now check on them remotely instead of manually. Belimo also offers smoke extraction actuators. Instead of helping dampers to close vents in the case of a fire, smoke extraction actuators open ventilation systems to release smoke in the case of an emergency. For these reasons, OEMs also have exclusive contracts with Belimo to produce their Fire & Safety actuators (~50% m.s in this vertical). While subtle, a high level of thought goes into the design & innovation of their products.

Asset-light manufacturing through a robust supply chain:

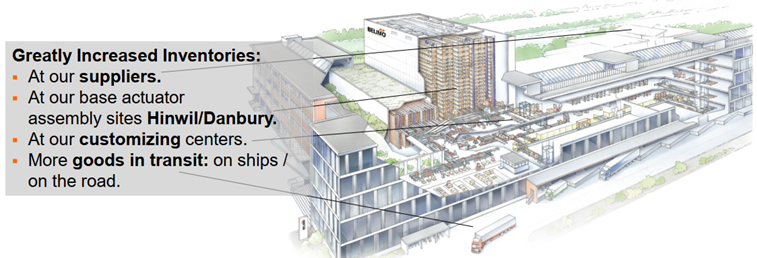

As you will observe in the financials, a significant contributor to Belimo’s returns is how they outsource production. Most of Belimo’s value-add comes from its ability to design, assemble (in the early stages) and test, customization & distribution (in the latter stages) of production. However, to ensure that the quality of products matches their value-add, they are extremely selective in whom they choose as their suppliers. Roughly ~88% of Belimo’s production costs are paid to suppliers vs ~12% for assembly, testing and distribution. Hence, when it comes to their partnership, they take a very detailed approach to selection and verification.

With 400+ suppliers globally, all are subject to audits, risk assessments and categorized into either A, B or C-tier suppliers. Suppliers are expected to grant Belimo full transparency to their financial records, quality checks for their own suppliers, and standards of operations. Each supplier is also measured on numerous KPIs and indicators to access their deliverables. From this, they are granted to evolve with Belimo gradually. Once a strong relationship is established, Belimo can give that supplier the autonomy to be involved in product design and development, making the process more efficient. Nearly 1/3rd of Belimo’s suppliers have been with them for over fifteen years, and roughly five new suppliers are added yearly. It is safe to state that not only do they manage the process well, but they also have good relationships with their suppliers. According to one analyst, Belimo pays them quickly and fairly and maintains consistent purchasing volumes. They do not try to squeeze their suppliers. During COVID, this benefited Belimo as suppliers had set aside inventory for them, easing their ability to supply customers when their peers had shortages. Coming out of COVID, Belimo has stated this allowed them to gain market share at the expense of their peers. In Belimo’s words, “maintaining supply availability & superior lead times were the main success factors in a year with global supply chain shortages.”

Belimo’s Capex over the Decade: In the last two decades, Belimo has only had roughly ~3 large capex cycles. First, in 2001/2002, to consolidate different locations in Switzerland into one central place; second, in the U.S. in 2014/15, to expand manufacturing and third, in 2020/21, to expand manufacturing in India. The key purpose of these initiatives is not only to bring more capacity online but to move closer to their suppliers compared to prior decades where it was more spread out. This has benefitted them in being able to out-compete their peers by having superior lead times.

M&A is not a priority:

Regarding M&A, Belimo, like the rest of its operations, takes a strategic approach. The board & management teams do not prioritize acquisitions as a means to grow, historically and moving forward. They believe it could impact not only their strong balance sheet but also the company's origin of “Swiss” quality & culture. However, where Belimo tends to be more active is for small transactions (<~10mn in sales) that are either a new avenue for growth (i.e., in the Water & Sensors), complimentary to their current offers, or they will acquire its sales agents/distributors and suppliers once it reaches a certain level of revenue.

.... I am trying to update the backend/financials given most of my graphs were scrambled & deleted...

Disclaimer

I do not own shares of BEAN.

This blog (aka "coconutgrapefruit") is for informational and educational purposes only and does not constitute investment advice. I am not a licensed financial advisor. All views are my own and based on personal research, which may be incomplete or inaccurate.

Investing involves risk. Always do your own due diligence or consult a professional before making any investment decisions. I may hold positions in securities mentioned.